SP 8-80b – Surplus Property Disposal for System Office

Colorado Community College System / System Procedure

SP 8-80b

APPROVED: April 29, 2014

EFFECTIVE: April 29, 2014

RENUMBERED: August 25, 2016

RENUMBERED: November 29, 2016

REVISED: February 14, 2024

RENUMBERED: February 14, 2024

REFERENCES: Board Policy (BP) 8-80, Surplus Property; System Procedure (SP) 8-80a, Surplus Property; System Accounting Procedure 17, Property, Plant and Equipment

APPROVED:

/ Joseph A. Garcia /

Joseph A. Garcia, Chancellor

APPLICATION

This procedure applies to the System Office within the Colorado Community College System (CCCS or System).

This procedure defines the process for transferring or disposing of moveable System Office property, regardless of the asset classification. It applies to equipment that is movable and not permanently attached to a building. It excludes land, land improvements, leasehold improvements, buildings, and fixtures. Definitions of asset and non-asset classes are contained in System Accounting Procedures.

For questions regarding the classification of an item that should be disposed of, contact the System Controller’s office for assistance.

Any item determined to be of no value or obsolete, must be approved for disposal through the Surplus Property Manager in accordance with this procedure.

PROCEDURE

Disposal of equipment should be accompanied by the appropriate Surplus Property Form (available in the Appendices) and forwarded to the Surplus Property Manager responsible for the type of item being disposed of.

| Surplus Property Managers | Department | Areas of Responsibility |

|---|---|---|

| System Controller | Fiscal Surplus Property Manager | General Equipment and Final Approval |

| Director of Facilities | Facilities Surplus Property Manager | Furniture, Vehicles, and Equipment Exposed to Hazardous Materials |

| Chief Technology Officer | IT Surplus Property Manager | Computers and Peripherals |

The appropriate Surplus Property Manager shall determine the residual value of the item and the disposal method.

The Surplus Property Manager shall assess the Fixed Asset Listing by contacting the CCCS Fiscal office to determine the historical cost and funding source of the item to be disposed of.

Items not purchased with federal funds can be disposed of as soon as the Surplus Property Form is completed and approved by the department Vice Chancellor. Items purchased with federal funds must follow the steps under “Special Considerations”.

When facilitating a sale, Surplus Property Managers must consult with the System Controller to address cash handling procedures and collection of sales tax. All payments must be made directly to the Fiscal office.

All disposals must be routed to the System Controller’s office for final approval. The System Controller must also ensure that each item is removed from the CCCS fixed assets records.

Valuation of Equipment:

The value of equipment shall be determined by the current market value of like items of like age, unless the item meets an exception noted in a specific equipment category. Viable valuation tools can include online auctions or similar forums if the items are sold through more focused venues. If the valuation is highly subjective, more than one source may be required to determine residual value.

CCCS considers all items with a historical cost of $10,000 or less to have zero residual value after ten (10) years (unless otherwise stated in a specific category).

Hazardous or Sensitive Property:

If the item contains hazardous materials or contains sensitive or restricted data, appropriate steps must be taken by the Surplus Property Manager to ensure the items are disposed of properly and that any data is removed in such a way that it cannot be restored.

All disposals of equipment exposed to or containing hazardous materials should be routed through the Facilities Surplus Property Manager.

All items that have been exposed to or contain hazardous materials should be disposed of according to applicable regulations. If department personnel are uncertain as to whether an item has been exposed to or contains hazardous materials, they should contact the Facilities Surplus Property Manager prior to completing the form.

General Disposal Methods:

All disposal of surplus property must be in accordance with laws, regulations, and applicable Board Policies and System Procedures. Acceptable means of disposal of equipment no longer used by the System Office include:

- Relocate within CCCS

- Transfer to another department within the System Office;

- Use as a trade-in;

- Transfer to a public entity that operates a program for which the equipment was originally purchased;

- Resale through appropriate channels as determined and carried out by Surplus Property Managers, including:

- Public or silent auction;

- Vehicle sales through State Fleet;

- Discard through trash removal.

The existing net book value should be used for items that are relocated or transferred within CCCS, such that no gain or loss is recognized. Fiscal records must be updated based on the Surplus Property Form.

All equipment being disposed of, regardless of historical cost or residual value, requires the completion of a form and approvals.

Computers and Peripheral Equipment:

All disposals of Information Technology (IT) equipment shall be coordinated through the CCCS IT department.

The Surplus IT Property Manager shall determine the current value of the item and the best means of disposal, based on the historical cost of the item, the original date of purchase, and the current market value of similar items. The information used in determining residual value shall be attached to the Surplus Property Disposal Form and forwarded to the System Controller’s office.

CCCS considers all computers and laptops with a historical cost of $5,000 or less to have zero residual value after seven (7) years of service, due to obsolescence in the information technology field.

CCCS considers all peripherals with a historical cost of $10,000 or less to have zero residual value after 10 years of service due to obsolescence in the information technology field.

Furniture:

All disposal of furniture items with a historical cost of $5,000 or more shall be routed through the Facilities Surplus Property Manager.

CCCS considers all furniture with a historical cost of $10,000 or less to have zero residual value after fifteen (15) years of service.

Vehicles:

All vehicles for disposal should be routed through the Facilities Surplus Property Manager.

Vehicles will be disposed of as follows:

- State Fleet vehicles: Return to State Fleet.

- Passenger vehicles and trucks: If inoperable, sell for scrap. If operable, use as a trade-in or sell through an auction, which may be an online auction forum.

- Small utility vehicles: If inoperable, sell for scrap. If operable, use as a trade-in or sell through an auction, which may be an online auction forum.

- Specialized maintenance equipment (including tractors, mowers, generators, sweepers, and equipment used to maintain the facilities and grounds): If inoperable, sell for scrap. If operable, use as a trade-in or sell through an auction, which may be an online auction forum.

- Donated vehicles: Dispose of in accordance with the donor agreement or, if unspecified, in accordance with the appropriate vehicle category.

CCCS considers all vehicles with a historical cost of $20,000 or less to have zero residual value after ten (10) years of service.

Limitations on Sales of Surplus Property:

All sales of surplus property must be made available through a public bidding process and advertised accordingly. Transferring or donating items to private entities or individuals without consideration is specifically prohibited.

Equipment cannot be purchased by CCCS employees or their families unless they participate through a public auction. CCCS employees who facilitate such events cannot participate in bidding, nor can their families.

Special Considerations:

The System Controller is responsible for ensuring any debt covenants are considered prior to the disposal of equipment purchased through certificates of participation or other debt instruments.

Any disposal of an item purchased with federal funds will be researched in cooperation with appropriate program and fiscal personnel to determine whether the awarding department placed restrictions on the disposal of the item. Any restrictions will be met.

Items donated to CCCS will be researched to ensure any donor requirements for disposal are met.

Recordkeeping:

All records related to disposal will be archived with Fiscal records for seven (7) years after the date of the disposal.

REVISING THIS PROCEDURE

CCCS reserves the right to change any provision or requirement of this procedure at any time and the change shall become effective immediately.

APPENDICES

Please contact the CCCS Fiscal Department for the appropriate forms or click below to download.

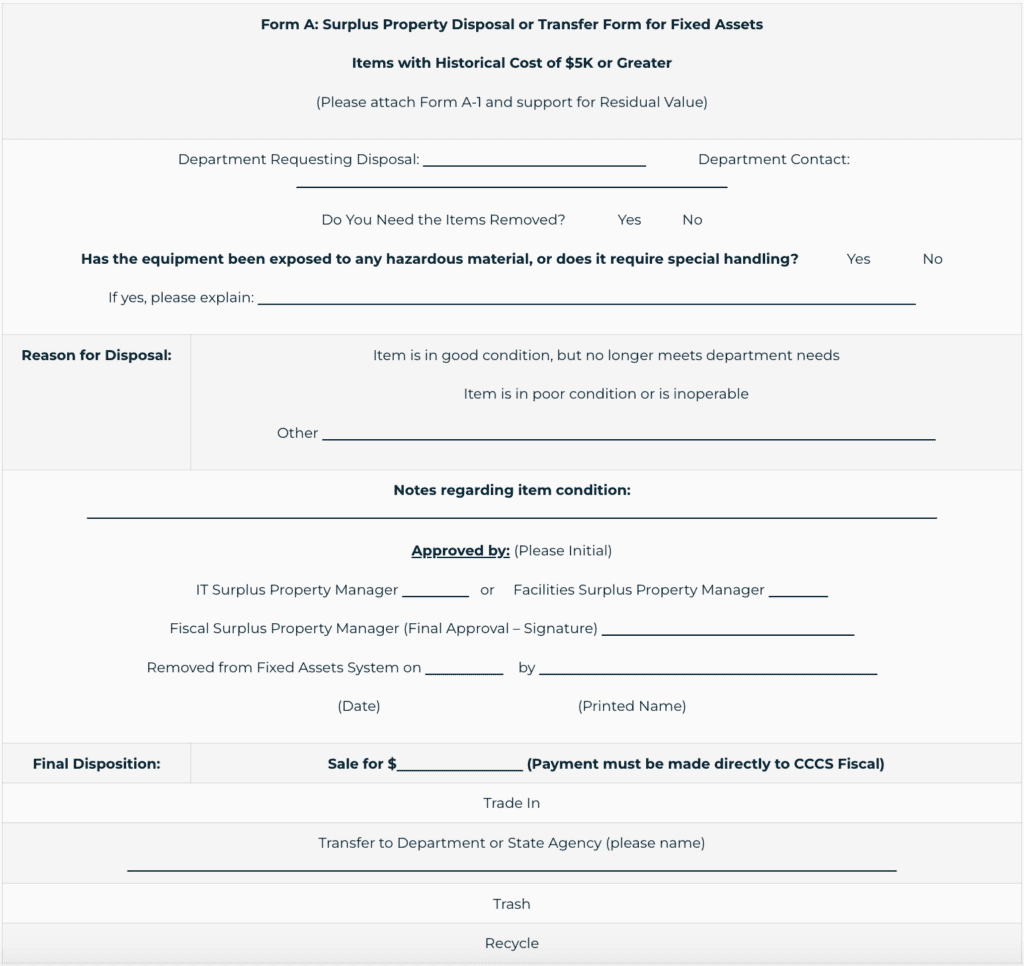

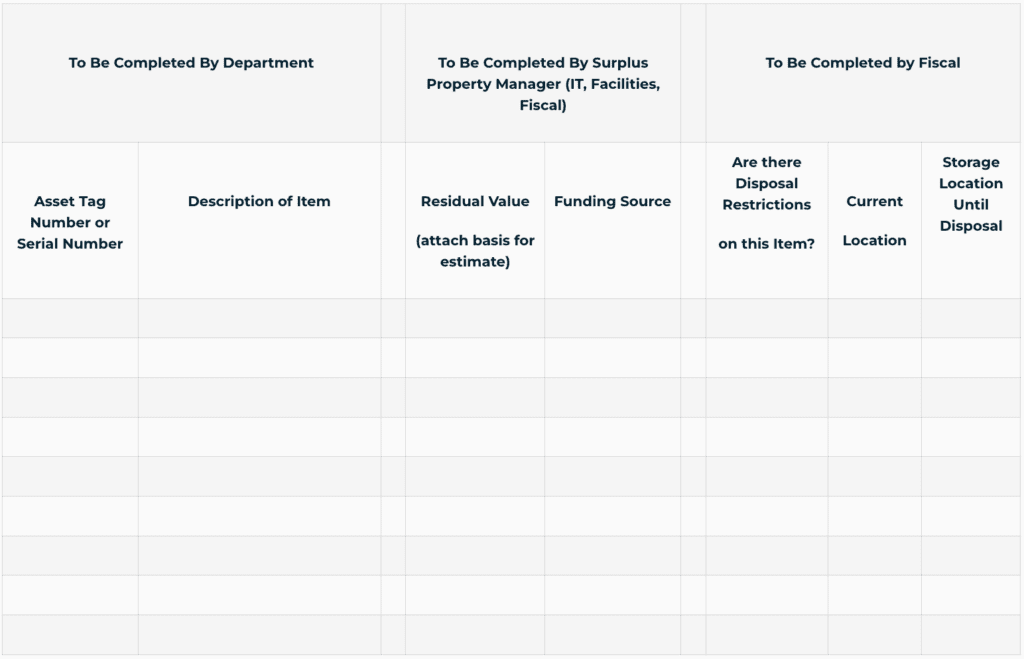

Form A – over $5k

Form A-1 – over $5k

Form A-1: Surplus Property Disposal or Transfer Form for Fixed Assets

For Items with an Original Cost of $5K or Greater

(Please attach to Form A along with support for Residual Value)

Item Information:

(Signature)

Please send completed Form to Fiscal Updated 12/2022

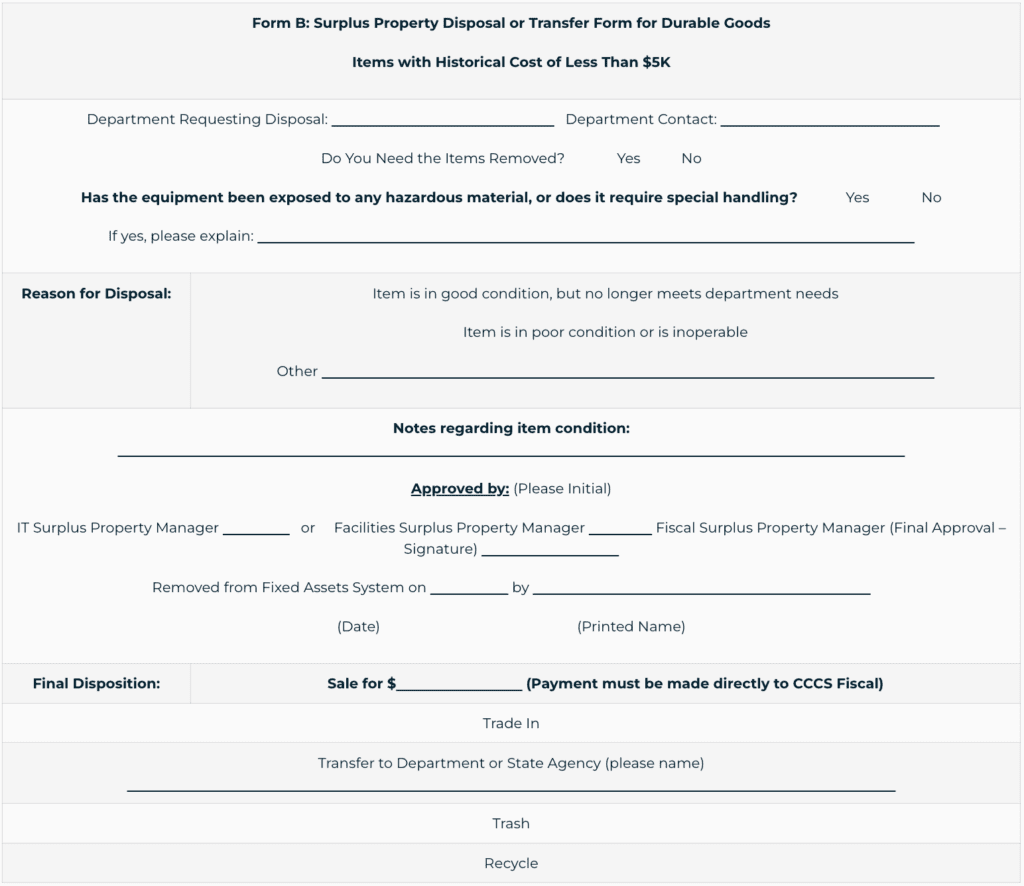

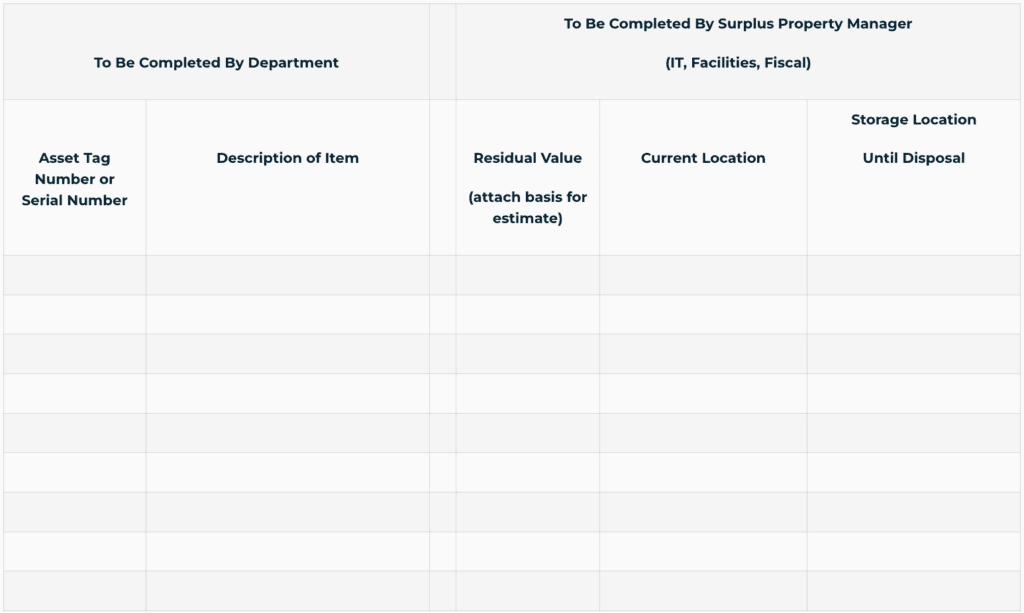

Form B – under $5k

Form B-1 – under $5k

Form B-1: Surplus Property Disposal or Transfer Form for Durable Goods

For Items with an Original Cost of Less Than $5K

(Please attach to Form B along with support for Residual Value)

Item Information:

(Signature)

Please send completed Form to Fiscal Updated 12/2022